JULY 26, 2011 – As July came to an end, the United States central government had come up against its congressionally mandated debt ceiling. Without an agreement to raise that debt ceiling – last set at $14.3-trillion – the U.S. central government will be unable to borrow money to pay its bills. The consequences could be extremely serious – soaring interest rates, a collapse of the U.S. dollar, not to speak of social security stipends, pensions and salaries going unpaid.

The barrier to raising the debt ceiling comes from the sudden rise of a new right-wing in the Republican Party. The 2008-2009 Great Recession has not yet, unfortunately, led to the creation of a mass new left in the United States. Instead, anger against capitalism has been politically captured by the far right in the so-called “Tea Party” movement. Deeply reactionary and with barely disguised racist undertones, the Tea Party conservatives have a simple answer to the ills facing the U.S. – too much government, too many taxes.

This simplistic message captured first the Republican Party, and then the House of Representatives, last year’s congressional elections seeing the House fall under the control of a Tea Party dominated Republican Party.

These Tea Party Republicans will not countenance raising the debt ceiling unless big steps are taken to deal with the U.S. deficit. And they are insisting that this happen without any increase in taxes.

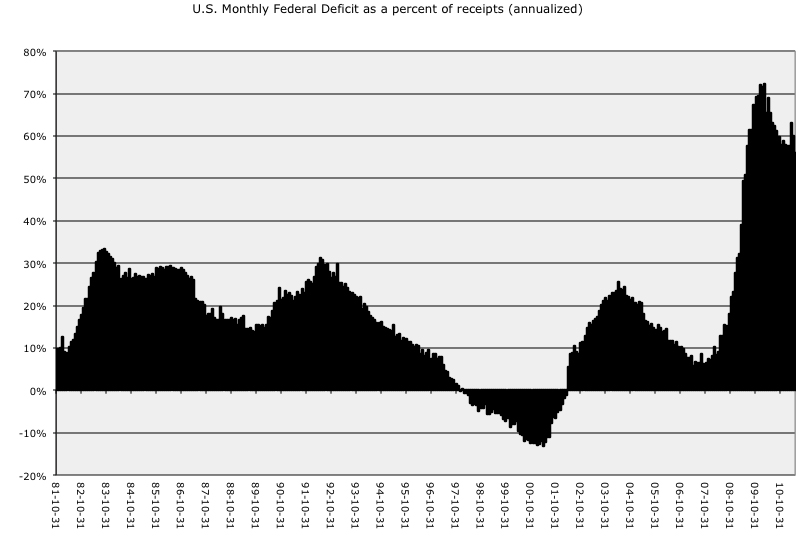

There is an enormous deficit problem in the U.S. central government. The $14.3 trillion debt figure, so much in the news, is the result of a decades-long practice of spending, every month, far more than comes in from revenues. The chart on this page documents this clearly.[1] Through all of the 1980s and most of the 1990s, deficits as a percent of receipts became quite high, twice reaching annual rates of 30 percent. For comparison’s sake, that would be like an individual making $3,000 a month, and every month supplementing that with about $1,000 on a credit card.

In the context of the economic boom of the 1990s, there was a brief reversal of this trend, the last four years of the Bill Clinton presidency and the first year of the presidency of George W. Bush actually seeing revenues exceed expenditures. But from 2002 to the present, there has been a return to deficit spending, peaking first during the height of the Iraq war, and then soaring in the context of the 2008-2009 recession. At its peak in 2009, deficits soared to 70% of revenues. Remember that person bringing in $3,000 a month? Now s/he would be taking out cash advances of $2100.

But is it really credible to try and fix this problem without tax increases? The key taxes that need to be addressed are not those paid by individual, but rather those paid by corporations.

In the 1950s, corporations paid 39% of all income taxes. By the 1970s this had fallen to 25%. In the first nine years of the 21st century, the figure was 19%.[2] Making corporations simply pay the share of income tax they did in the 1950s, or even the 1970s, would make a huge dent in the deficit. And in 2011, corporations have the money to pay new taxes. Story after story in the press documents that Corporate America is sitting on record piles of cash.[3]

The Tea Party Republicans will not look at these facts. Instead they are insisting on reducing the deficit strictly through cuts in expenditures. After President Obama’s dramatic speech to the U.S. July 25, CNN commentators summarized what that means – cuts to “the Big Three: medicare, medicaid and social security.”

But what about the “Big One” – warfare? In Canada, about eight per cent of central government expenditures goes towards warfare. That is enough to rank Canada quite high on the list of arms spenders in the world, 13th in the world, according to arms spending experts in Sweden.

But the United States is in a whole other league. Fully 43% of all money spent on arms in the world is spent by the United States government.[4] It means that instead of 8%, a shocking 20% of its budget goes towards the military.[5] But the military establishment is barely part of the discussion for the Tea Party right wing.

Here’s the big problem. If the Tea Party right wing won’t talk about raising corporate taxes and cutting the bloated military budget, neither will President Obama.

In his speech July 25 he talked about “the tough challenges of entitlement and tax reform.” By entitlement, he means exactly what the CNN commentators headlined – medicare, medicaid and social security. The “Grand Bargain” that Obama tried to win this month involved billions of dollars in cuts to these vital social services.[6] He, like the Tea Party Republicans, will not raise the issue of the biggest driver of expenses in the United States – the war machine.

Unlike the Republicans, he does talk about tax increases. But listen closely. He quite rightly wants to roll back the wildly generous tax breaks given, by George W. Bush, to the richest citizens of the United States. But he is not putting on the table the really big item – the need to seriously tax the corporations.

The bitter truth is that both Democrats and Republicans – for all their differences – share two fundamental viewpoints. Both agree that corporate power needs to be nurtured as the only way to drive the economy. And both agree that the U.S. needs to maintain its imperial interests abroad, an empire which will come unstuck without a truly massive arms budget.

Instead, both are insisting that ordinary citizens pay for the deficit and debt – even though these twin problems were created by handouts to corporations, and trillions wasted on sending young men and women to die for corporate profits abroad.

The deficit/debt problem can be dealt with – by taxing the corporations and by attacking the warfare state.

But those demands will have to come from new social movements, independent of Obama and the Democrats.

Publishing History

This article has been published as “United States: Debt crisis – the issue is the war machine, not welfare,” Links, 27 July.Part of a series of articles based on a recent trip to the United States

© 2011 Paul Kellogg. This work is licensed under a CC BY 4.0 license.

References

[1] Compiled from Financial Management Service, A Bureau of the United States Department of the Treasury. “MTS: Monthly Treasury Statement: Quick Links – Monthly Receipts, Outlays, and Deficit or Surplus, Fiscal Years 1981-2010.” June 2011 < http://www.fms.treas.gov/mts/index.html>

[2] According to Julie Snider, Investigative Reporting Workshop. “Graphic: Who pays the taxes?” What Went Wrong: The Betrayal of the American Dream. February 7, 2011. <http://americawhatwentwrong.org/stories/who-pays-taxes/>

[3] For a recent news story covering this phenomenon, see John Melloy. “Firms Have Record $800 Billion of Cash But Won’t Hire.” CNBC. June 22, 2011. < http://www.cnbc.com/id/43499606/Firms_Have_Record_800_Billion_Of_Cash_But_Still_Won_t_Hire>

[4] Compiled from Stockholm International Peace Research Institute (SIPRI). “SIPRI Military Expenditures Database.” 2011. < http://www.sipri.org/databases/milex>

[5] Based on calculations in Paul Kellogg, “From the Avro Arrow to Afghanistan: The political economy of Canadian militarism.” In Greg Albo and Jerome Klassen, eds. Empire’s Ally: Canadian Foreign Policy and the War in Afghanistan. Toronto: University of Toronto Press, forthcoming).

[6] Lori Montgomery. “In debt talks, Obama offers Social Security cuts.” The Washington Post. July 6, 2011. < http://www.washingtonpost.com/business/economy/in-debt-talks-obama-offers-social-security-cuts/2011/07/06/gIQA2sFO1H_story.html>